Navigating The Mortgage Process

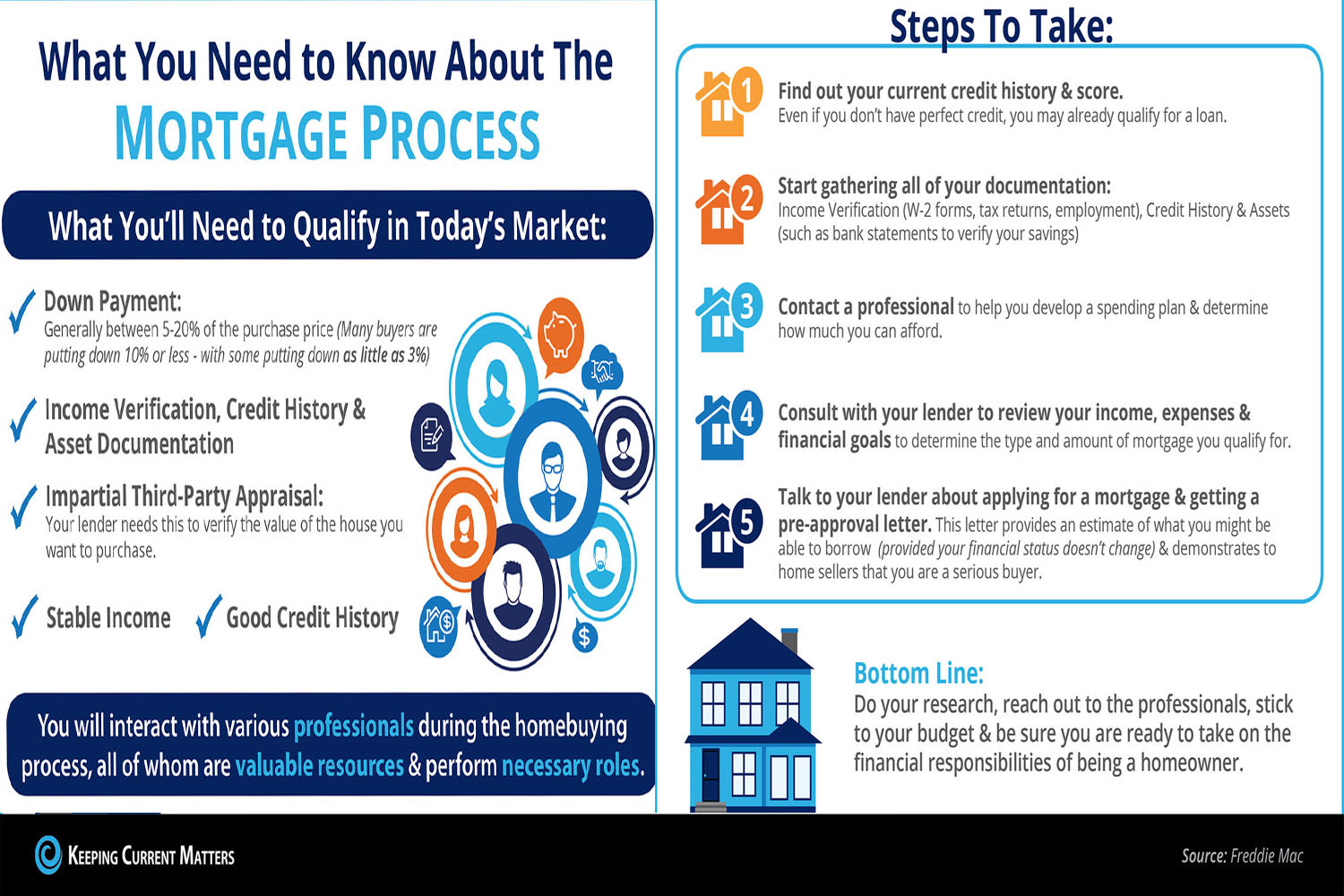

Navigating the mortgage process can be complex, but understanding its key elements can greatly

simplify the journey to home ownership. The mortgage system involves several important stages:

pre-approval, application, underwriting, and closing, each critical to successfully securing a home

loan.

Pre-Approval

The first step in the mortgage process is getting pre-approved. This involves a preliminary check

of your credit score and financial history to determine how much you can borrow. It’s advisable to

approach this step with a strong credit profile, as this can significantly affect your loan terms,

including interest rates.

Application

Once you’re pre-approved, the next step is the mortgage application. This detailed form requires

information about your income, debt, assets, employment, and the property you’re interested in

buying. Accuracy is crucial here to ensure smooth processing.

Underwriting

After submitting your application, it enters the underwriting phase. During this stage, a mortgage

underwriter reviews all provided information to verify its accuracy and ensure that it meets all the

lender’s requirements. This risk assessment is vital for determining whether the loan will be

granted.

Closing

The final step in the mortgage process is closing. This includes signing all necessary documents

to complete the purchase. It’s important to understand all the closing costs involved, which can

include appraisal fees, attorney fees, and escrow deposits.

Throughout the mortgage process, it’s beneficial to keep communication lines open with your

lender. Ask questions and provide necessary documentation promptly to avoid delays. Also,

understanding the role of interest rates, loan types (like fixed-rate and adjustable-rate), and loan

terms will help in making an informed decision that aligns with your financial goals.

In summary, the mortgage process, from pre-approval to closing, involves several key steps that

require careful preparation and active participation. By comprehending each stage and preparing

adequately, prospective homeowners can navigate this complex process with greater confidence

and success.